Shopify Capital Loan is a financing solution tailored for Shopify merchants, enabling them to access funds directly through their Shopify account. This loan option helps Shopify businesses grow by providing easy access to capital without traditional bank requirements. Merchants can use this funding to boost inventory, manage cash flow, or invest in marketing, all while enjoying flexible repayment terms tied to their daily sales.

How Shopify Capital Loan Works

Shopify Capital offers two main financing options for merchants:

- Loan: Merchants receive a specific loan amount with a fixed repayment rate.

- Merchant Cash Advance: Shopify provides a cash advance that merchants repay as a percentage of future sales until the advance and fees are fully repaid.

Once a merchant accepts an offer, funds are deposited within a few days, and repayments are automatically deducted from daily sales, making it a seamless process for Shopify store owners.

Eligibility and Requirements

Not all Shopify merchants qualify for Shopify Capital Loan, as the platform selects eligible stores based on specific criteria:

- Sales Volume: Regular sales volume indicates the merchant’s repayment ability.

- Store Performance: Positive metrics and high-quality product offerings may increase eligibility.

- Duration on Shopify: Stores that have been on Shopify for a few months and show consistent growth are more likely to qualify.

Shopify analyzes various factors to determine loan eligibility, so regular store maintenance and sales growth can improve chances of qualifying for funding.

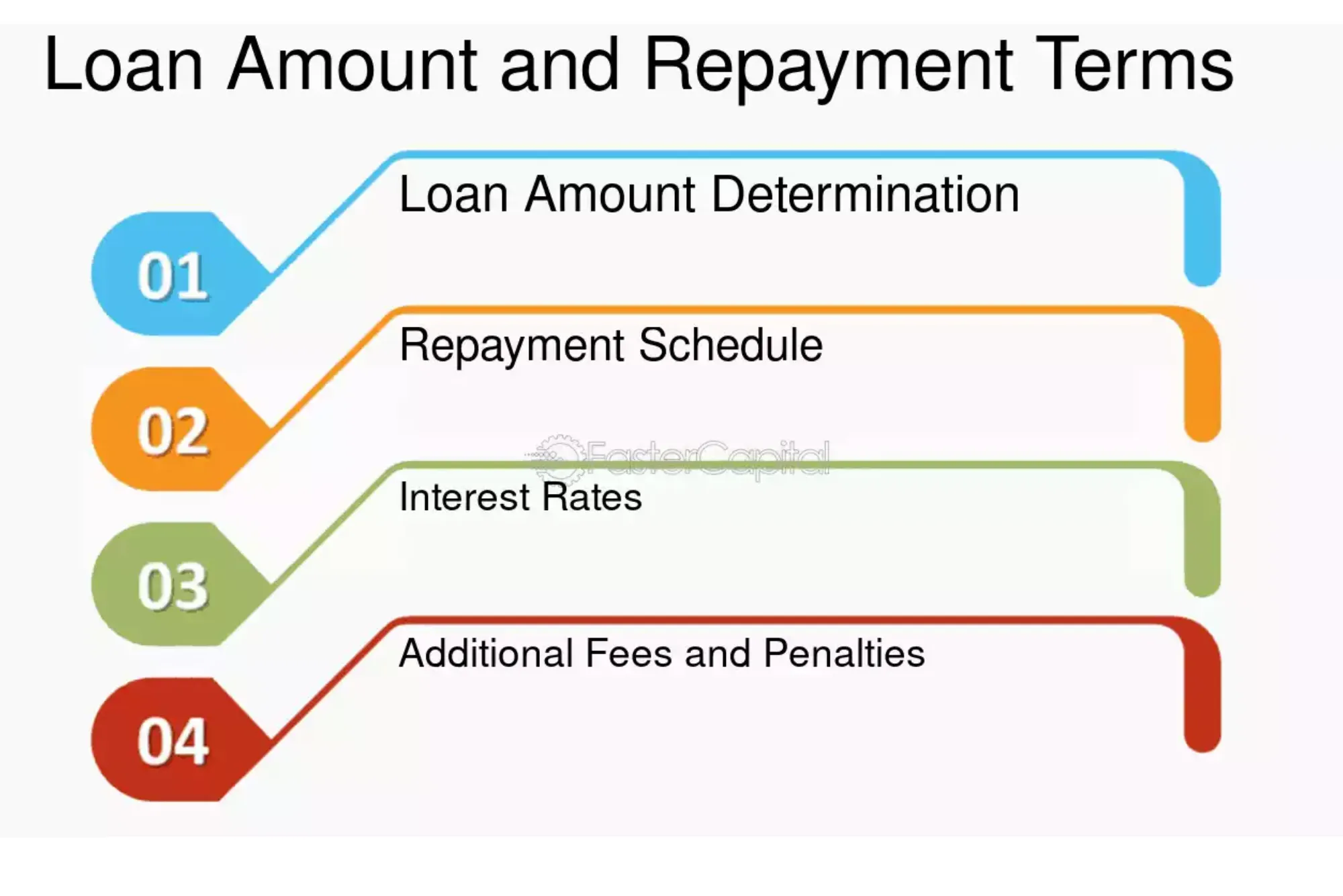

Loan Amounts and Repayment Terms

The loan amounts and repayment terms vary based on the store’s sales performance and Shopify’s analysis:

| Factor | Details |

|---|---|

| Loan Amounts | Varies based on store performance (usually between $200 – $1 million) |

| Repayment Terms | Automatically deducted from daily sales |

| Repayment Rates | Typically 10-25% of daily sales until fully repaid |

| Duration | Flexible; depends on daily sales volume |

These flexible terms allow merchants to repay the loan at a comfortable pace, with automatic deductions aligned to their sales volume.

Benefits of Shopify Capital Loan

Choosing Shopify Capital over other financing options provides various benefits:

- Fast Access to Funds: Eligible merchants can receive funds within days of accepting the offer.

- No Personal Credit Checks: Shopify assesses only store performance, making it accessible for new businesses.

- Flexible Repayment: Payments adjust based on daily sales, providing more flexibility during slower periods.

- No Collateral Needed: Merchants don’t have to pledge assets to secure the loan.

Potential Drawbacks and Considerations

Although Shopify Capital Loan provides fast funding, merchants should consider potential drawbacks:

- Impact on Cash Flow: High repayment percentages can reduce daily profit margins.

- Limited Loan Amounts: Loan amounts are tied to store performance and may be lower than other financing options.

- Eligibility Dependence on Sales Fluctuations: A decrease in sales volume could affect future eligibility.

These considerations highlight the need for merchants to evaluate Shopify Capital in the context of their cash flow and funding needs.

Comparison to Other Business Funding Options

Comparing Shopify Capital Loan to other business funding options can help merchants make a more informed choice:

| Funding Option | Pros | Cons |

|---|---|---|

| Shopify Capital Loan | Fast approval, no credit check, flexible repayment | Limited amounts, requires Shopify account |

| Bank Loan | Potentially larger amounts, lower interest | Longer approval process, requires good credit |

| SBA Loan | Low-interest rates, large loan options | Lengthy application, stringent requirements |

| Merchant Cash Advance | Fast funding, flexible repayments | Higher fees, affects daily cash flow |

Shopify Capital is ideal for Shopify users needing quick, short-term funding without lengthy paperwork, while other funding options might better suit those looking for larger loans with more extended repayment terms.

How to Apply for a Shopify Capital Loan

Step-by-Step Application Process

- Check for Pre-Approval: Shopify contacts eligible merchants directly.

- Review Loan Offer: The loan offer will include the loan amount, repayment rate, and fees.

- Accept the Offer: Click to accept the offer directly on your Shopify dashboard.

- Receive Funds: Funds are typically deposited within 2-5 business days.

Tips for a Smooth Application

- Maintain steady sales to improve eligibility.

- Keep a positive customer experience record to strengthen store performance metrics.

Merchants eligible for Shopify Capital Loans can apply directly within their dashboard, streamlining the funding process.

Frequently Asked Questions (FAQs)

Q1. What happens if my sales drop?

If sales drop, your daily repayment rate decreases since it’s based on a percentage, not a fixed amount.

Q2. How soon can I reapply after repaying my loan?

Merchants can reapply once the current loan is repaid, though eligibility will be reassessed by Shopify.

Q3. Can I use Shopify Capital for expenses other than inventory?

Yes, you can use the funds for any business-related expenses, including marketing, new products, or operations.

Q4. Are there any hidden fees?

No, Shopify provides clear terms upfront, and there are no hidden fees.

Q5. Does Shopify Capital affect my personal credit score?

No, Shopify only evaluates your store performance; personal credit checks are not involved.

Success Stories and Case Studies

Many Shopify merchants have leveraged Shopify Capital to scale their businesses. For instance:

- Merchant A used Shopify Capital to expand inventory, leading to a 40% increase in monthly revenue.

- Merchant B utilized funds for a marketing campaign, increasing their customer base significantly.

These examples showcase how Shopify Capital can be a powerful tool for merchants aiming to grow their operations.

Shopify Capital Loan is a practical and flexible financing option for Shopify merchants looking to boost their business growth. With fast access to funds and repayments tied to daily sales, it allows store owners to focus on scaling their operations. For those eligible, Shopify Capital is worth exploring as a convenient and user-friendly way to access working capital.

SEO Meta Title and Description

- Meta Title: Shopify Capital Loan: Flexible Financing for Shopify Merchants

- Meta Description: Discover how Shopify Capital Loan provides quick, flexible funding for Shopify merchants, helping boost growth with easy repayment options tied to daily sales.

Table Summary

| Aspect | Details |

|---|---|

| Funding Options | Loan and Merchant Cash Advance |

| Eligibility Requirements | Based on sales, performance, and store history |

| Repayment Terms | Percentage of daily sales (10-25%) |

| Benefits | Quick funding, flexible payments, no credit check |

| Potential Drawbacks | High repayment rates impact cash flow, limited amounts |

This structure offers a comprehensive overview, helping users understand Shopify Capital Loan and decide if it aligns with their business needs. Let me know if you’d like more details on any section